-

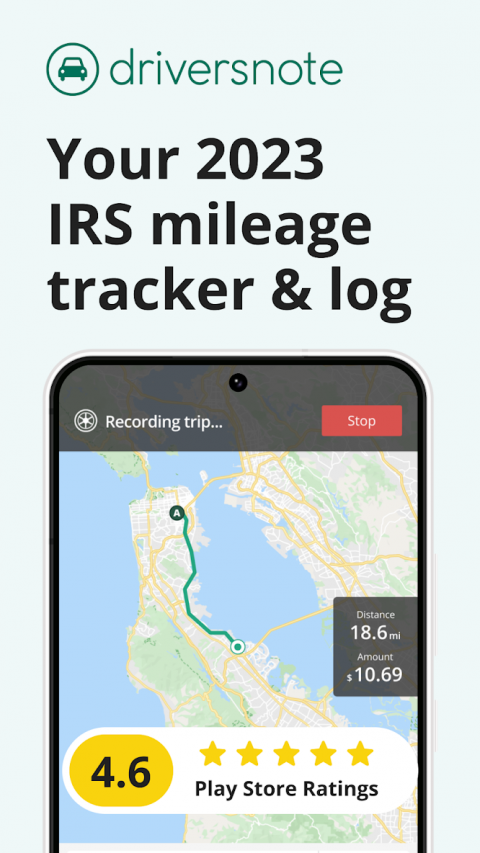

Mileage Tracker on Autopilot by Driversnote

Latest Version: Publish Date: Developer: 3.0.12 2020-09-23 Driversnote Mileage Tracker

The description of Mileage Tracker on Autopilot by Driversnote

What is the Mileage Tracker on Autopilot by Driversnote application, how does it work?

According to the introduction of Driversnote Mileage Tracker, Mileage Tracker on Autopilot by Driversnote is a Auto & Vehicles app on the Android platform. There is currently a 3.0.0 version released on Mar 04, 2020, you can see the details below.

Take the pain out of tracking business driving! Automatically track your mileage and get the most out of your IRS tax deductions and company reimbursements with our free beautifully designed mileage tracker.The ideal mileage tracker app for the self employed who want to make the most of their money by claiming IRS tax deductions on driving. Ideal for employees who drive their personal car for work, and need to log trips for travel expense reimbursement. Save time by making your mileage tracker automatic and send reports directly from the app to your accountant.

500,000+ drivers already trust us with their mileage tracking

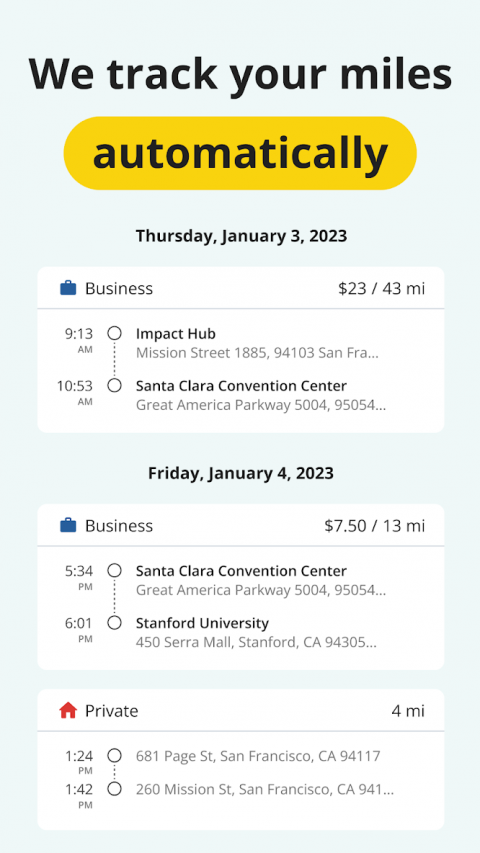

▶ AUTOMATIC TRACKING & DOWNLOADABLE MILEAGE LOG

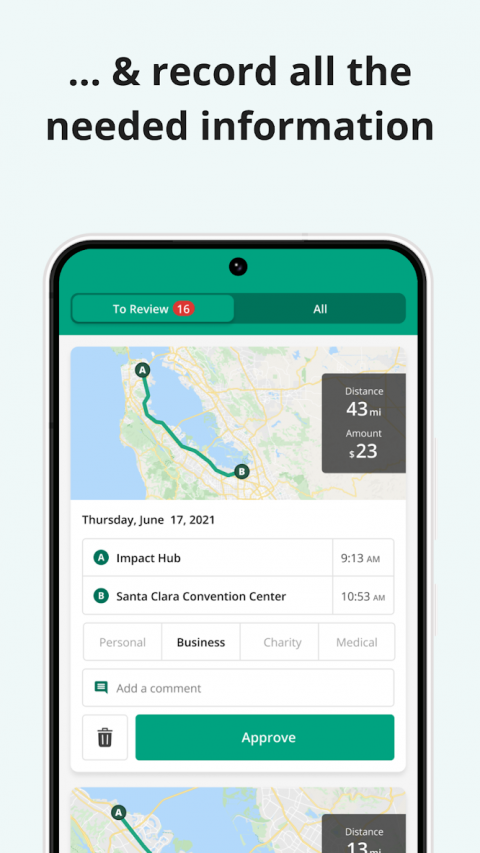

- Track your drives from start to finish with the push of a button

- Automatic tracking with iBeacon

- Manually add trips

- Categorize trips to split your business and personal driving

- Set working hours and automatically log your work driving

- Smart location suggestions for frequent and return trips

- Always have the current IRS mileage rates calculated for you

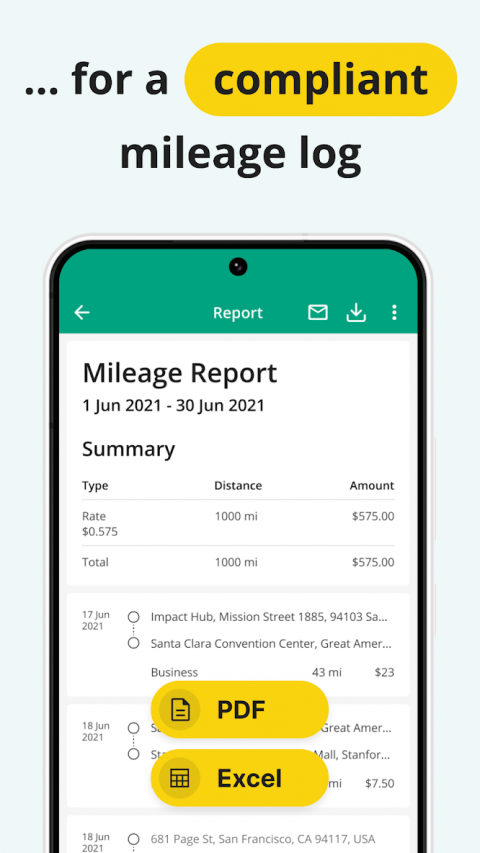

- Generate reports to send to your company or accountant

▶ BENEFITS

- Save money on tax deductions and get fair reimbursements for work driving

- Peace of mind: Your trips are all saved even if you lose your phone

- Save time on your mileage log and submit more accurate expense reports

- The IRS requires an accurate log of your trips and their purpose. Always have your business logs ready in case you need them.

▶ WHY TRACK YOUR MILEAGE?

When you’re self employed your money matters and your time is precious. If you’re self employed or drive a personal car for work you can earn more money by keeping a log of your driving, whether you’re a realtor or a Lyft / Uber driver or anyone else who needs to log their mileage. So you can get back to what you’re good at, being the best contractor or entrepreneur you can be.

About Our Mileage Log

Driversnote wants you to get the most out of your driving, so you can focus on doing what you do best.

If you have any questions or feedback about the app please contact us at [email protected]. We’re always happy to hear from you and want to know what you want out of your mileage log and expense reports.

**The app uses GPS in the background when logging trips and continued use of GPS can dramatically decrease battery life.

What's new of Mileage Tracker on Autopilot by Driversnote

| Category: | Requirements: |

|---|---|

| Auto & Vehicles | Android 5.0+ |

Related Apps for Mileage Tracker on Autopilot by Driversnote android

-

-

Car Fuel Log - Mileage tracker

2018-10-08

-

-

Phone Tracker By Number

2021-10-04