-

CASHe

Latest Version: Publish Date: Developer: 8.5.2 2020-09-27 CASHe

The description of CASHe

App store info

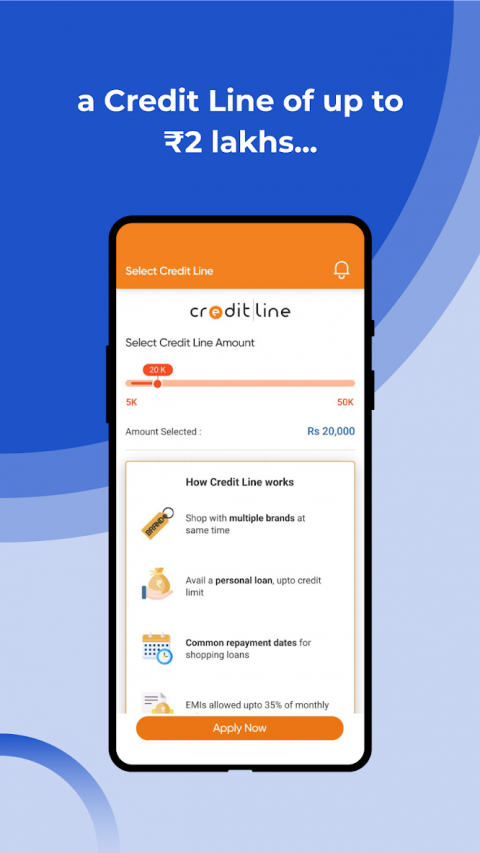

CASHe is one of India’s leading app-based credit lending platform which instantly underwrites and disburses short-term personal all through a smartphone app. Loans range from Rs 9,000 to Rs 3 lakhs with credit period ranging from 62 days to 1 year. We are revolutionizing the short-term personal loan market in India by creating a one-stop shop for young professionals who can now access credit in an elegant and uncomplicated way, instantly!

Eligibility

● Minimum salary: in-hand salary of ₹15,000/month

● Minimum age: 18 years or above and below 55 years

How to apply for a loan on CASHe

* Log in to the app by registering through your social media pages.

* Fill your details and upload basic documents to complete the mandatory KYC verification.

* Once verified, you will be notified on your eligible loan amount instantly.

* Apply for a loan and once it has been approved, we transfer the loan amount into your bank account in 10 minutes.

Documents required

* Selfie

* PAN card

* Address ID proof

* Aadhar card

* Bank statement

What You'll Love

● Avail instant loans through your smartphone

● Get instant collateral-free loans from as little as Rs 9,000

Loan disbursement in 10 minutes (Subject to submission of proper documents)

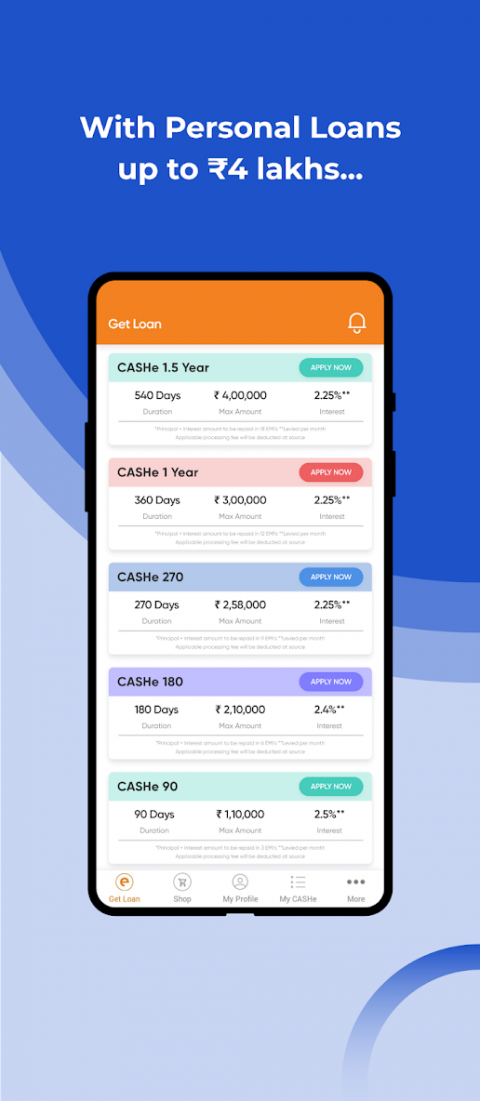

Wide range of loan products and tenors

Rs.9K– 80K for 62 days

Rs.19K – 100K for 90 days

Rs 25K – 200K for 180 days

Rs 50K – 250K for 270 days

Rs 75K– 300K for 360 days

Interest charges (APR) based on loan products

● 62 days @ 36.50% p.a.

● 90 days @ 33.46% p.a.

●180 days @ 36.50% p.a.

● 270 days @ 36.50% p.a.

● 360 days @ 36.50% p.a.

Sample loan calculation-

Loan amount: Rs 30,000 at interest rate of 33% p.a.

Loan Duration: 90 Days

Total Interest = Rs 2,475

Processing fees (PF) + GST = Rs 1000 + Rs 180 = Rs 1,180

Total Deductibles (PF + GST+ Interest): Rs 3,655

In-Hand Amount: Loan Amount - Total Deductibles = Rs 30,000 - 3,655 = Rs 26,345

Total repayable Amount: Rs 30000

Monthly EMI Repayable: Rs 10000

** The deductibles (interest + PF + GST) is deducted upfront during the loan disbursal.

Your data is safe with us

We have stringent security measures in place to protect the loss, misuse and alteration of information under control. We use Secure Sockets Layers (SSL) based encryption, for the transmission of the information, which is currently the required level of encryption in India as per applicable law.

We need the following permissions for the app to function properly

SMS*: Required to read your financial SMS sent by banks.

Location: Required to verify your current location for the loan application

Social media profile -Required to fetch the verified Facebook, LinkedIn and Google accounts for registration on the app.

Camera & Media Access: Required for enabling upload of loan application documents

Read Device Info: Required to link the unique phone ID (IMEI) to the loan application for security purposes

*Access to your SMS information

We do not collect, read or store your personal SMS from your inbox. We only monitor your SMS to ascertain the financial SMS sent by the 5 or 6-digit alphanumeric senders in your inbox. This helps us to identify the various bank accounts you are holding, description and amount of the transactions undertaken by you as a user. This is required to perform a risk assessment on your profile and make faster credit decisions.

Contact us at [email protected]

CASHe is one of India’s leading app-based credit lending platform which instantly underwrites and disburses short-term personal all through a smartphone app. Loans range from Rs 9,000 to Rs 3 lakhs with credit period ranging from 62 days to 1 year. We are revolutionizing the short-term personal loan market in India by creating a one-stop shop for young professionals who can now access credit in an elegant and uncomplicated way, instantly!

Eligibility

● Minimum salary: in-hand salary of ₹15,000/month

● Minimum age: 18 years or above and below 55 years

How to apply for a loan on CASHe

* Log in to the app by registering through your social media pages.

* Fill your details and upload basic documents to complete the mandatory KYC verification.

* Once verified, you will be notified on your eligible loan amount instantly.

* Apply for a loan and once it has been approved, we transfer the loan amount into your bank account in 10 minutes.

Documents required

* Selfie

* PAN card

* Address ID proof

* Aadhar card

* Bank statement

What You'll Love

● Avail instant loans through your smartphone

● Get instant collateral-free loans from as little as Rs 9,000

Loan disbursement in 10 minutes (Subject to submission of proper documents)

Wide range of loan products and tenors

Rs.9K– 80K for 62 days

Rs.19K – 100K for 90 days

Rs 25K – 200K for 180 days

Rs 50K – 250K for 270 days

Rs 75K– 300K for 360 days

Interest charges (APR) based on loan products

● 62 days @ 36.50% p.a.

● 90 days @ 33.46% p.a.

●180 days @ 36.50% p.a.

● 270 days @ 36.50% p.a.

● 360 days @ 36.50% p.a.

Sample loan calculation-

Loan amount: Rs 30,000 at interest rate of 33% p.a.

Loan Duration: 90 Days

Total Interest = Rs 2,475

Processing fees (PF) + GST = Rs 1000 + Rs 180 = Rs 1,180

Total Deductibles (PF + GST+ Interest): Rs 3,655

In-Hand Amount: Loan Amount - Total Deductibles = Rs 30,000 - 3,655 = Rs 26,345

Total repayable Amount: Rs 30000

Monthly EMI Repayable: Rs 10000

** The deductibles (interest + PF + GST) is deducted upfront during the loan disbursal.

Your data is safe with us

We have stringent security measures in place to protect the loss, misuse and alteration of information under control. We use Secure Sockets Layers (SSL) based encryption, for the transmission of the information, which is currently the required level of encryption in India as per applicable law.

We need the following permissions for the app to function properly

SMS*: Required to read your financial SMS sent by banks.

Location: Required to verify your current location for the loan application

Social media profile -Required to fetch the verified Facebook, LinkedIn and Google accounts for registration on the app.

Camera & Media Access: Required for enabling upload of loan application documents

Read Device Info: Required to link the unique phone ID (IMEI) to the loan application for security purposes

*Access to your SMS information

We do not collect, read or store your personal SMS from your inbox. We only monitor your SMS to ascertain the financial SMS sent by the 5 or 6-digit alphanumeric senders in your inbox. This helps us to identify the various bank accounts you are holding, description and amount of the transactions undertaken by you as a user. This is required to perform a risk assessment on your profile and make faster credit decisions.

Contact us at [email protected]

What's new of CASHe

Introducing Social Loan Quotient (SLQ), India’s first social behaviour-based credit rating system for young salaried millennials.

CASHe has now made SLQ accessible for every applicant to know if he/she is eligible for a loan with CASHe. All you need to do is to complete your profile and submit the necessary documents on to the app. Within minutes, the AI-based SLQ engine will let you know your credit profile status.

CASHe has now made SLQ accessible for every applicant to know if he/she is eligible for a loan with CASHe. All you need to do is to complete your profile and submit the necessary documents on to the app. Within minutes, the AI-based SLQ engine will let you know your credit profile status.

| Category: | Requirements: |

|---|---|

| Finance | Android 4.1+ |

Related Apps for CASHe android

-

-

CASHe

2020-09-27